If you have your own data that has/hasn't been processed, you should conform to the following structure. Basically, load your data into a Pandas dataframe object and be sure to convert the dates to datetime format, set dates to dataframe object index and include the following lowercase column titles.

index high low open close

2017-07-08 11:00:00 2480.186778 2468.319314 2477.279567 2471.314030

2017-07-08 11:30:00 2471.314030 2455.014057 2471.202796 2458.073602

2017-07-08 12:00:00 2480.000000 2456.000000 2458.073602 2480.000000

If you don't have your own data, we've included a useful function for grabbing historical charting data from the Poloniex exchange or from Cryptocompare. In this example, we'll trade the BTC/ETH pair on a 4H timeframe. With the poloniex helper function, it's easy to do that.

from gemini.gemini import Gemini

from gemini.helpers import poloniex as px

from gemini.helpers.analyze import analyze_bokeh

def logic(algo, data):

"""

Main algorithm method, which will be called every tick.

:param algo: Gemini object with account & positions

:param data: History for current day

"""

pass

pair = "ETH_BTC" # Use ETH pricing data on the BTC market

period = 1800 # Use 1800 second candles

days_history = 200 # Collect 200 days data

# Request data from Poloniex

df = px.load_dataframe(pair, period, days_history)

# Algorithm settings

sim_params = {

'capital_base': 10, # initial capital in BTC

'fee': {

'Long': 0.0025, # fee settings for Long

'Short': 0.0025, # fee settings for Short

},

'data_frequency': '4H' # Time frame to use (see /helpers/timeframe_resampler.py for more info

}

# Load data and settings to backtester core

gemini = Gemini(logic=logic, sim_params=sim_params, analyze=analyze_bokeh)

# Start backtesting custom logic with 10 (BTC) initial capital

gemini.run(df, show_trades=True)In addition to loading the data, you must define the strategy you want to test. To do this, we'll create a logic function that can be passed to the backtester when you start. If the data hasn't already been processed, you may process it within the logic function (this makes the simulation more accurate but significantly increases runtime). With those, you may execute long, sell, short, and cover positions directly on the "Account" class based on your strategy.

def logic(algo, data):

"""

Main algorithm method, which will be called every tick.

:param algo: Gemini object with account & positions

:param data: History for current day

"""

if len(data) < 2:

# Skip short history

return

today = data.iloc[-1] # Current candle

yesterday = data.iloc[-2] # Previous candle

# close positions

if len(algo.account.positions) > 0:

if today['close'] < yesterday['close']:

exit_price = today['close']

for position in algo.account.positions:

if position.type_ == 'Long':

algo.account.close_position(position, 1, exit_price)

# open positions

elif today['close'] > yesterday['close']:

risk = 0.03

entry_price = today['close']

entry_capital = algo.account.buying_power * risk

if entry_capital >= 0.00001:

algo.account.enter_position('Long', entry_capital, entry_price)After the backtest, you can analyze your strategy by printing the results to console. As of now, these include simple statistics of your run but we plan to implement more complicated metrics for a stronger understanding of performance.

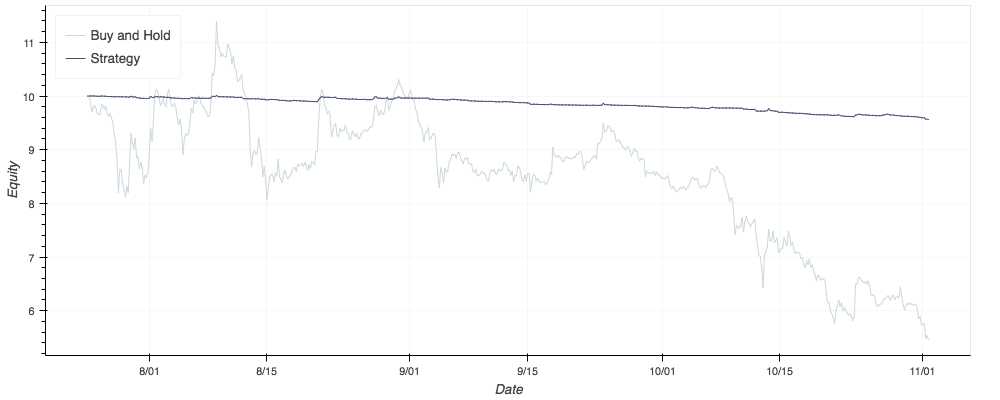

Buy and Hold : -45.63%

Net profit : -4.56

B & H MDD : -52.09%

Strategy : -4.38%

Net profit : -0.44

Strategy MDD : -4.49%

Longs : 269

Sells : 269

Shorts : 0

Covers : 0

--------------------

Total Trades : 538

You can visualize the performance of your strategy by comparing the equity curve with a buy and hold baseline. The equity curve simply tracks your account value throughout the backtest and will optionally show where your algorithm made its trades including longs, sells, shorts, and covers.

gemini.run(df, show_trades=True)

You can find this, and some more examples on /examples/

Please take a look at our contributing guidelines if you're interested in helping!