Synthetix is a crypto-backed synthetic asset platform.

It is a multi-token system, powered by SNX, the Synthetix Network Token. SNX holders can stake SNX to issue Synths, on-chain synthetic assets via the Staking dApp The network currently supports an ever-growing list of synthetic assets. Please see the list of the deployed contracts on MAIN and TESTNETS Synths can be traded using Kwenta

Synthetix uses a proxy system so that upgrades will not be disruptive to the functionality of the contract. This smooths user interaction, since new functionality will become available without any interruption in their experience. It is also transparent to the community at large, since each upgrade is accompanied by events announcing those upgrades. New releases are managed via the Synthetix Improvement Proposal (SIP) system similar to the EIPs

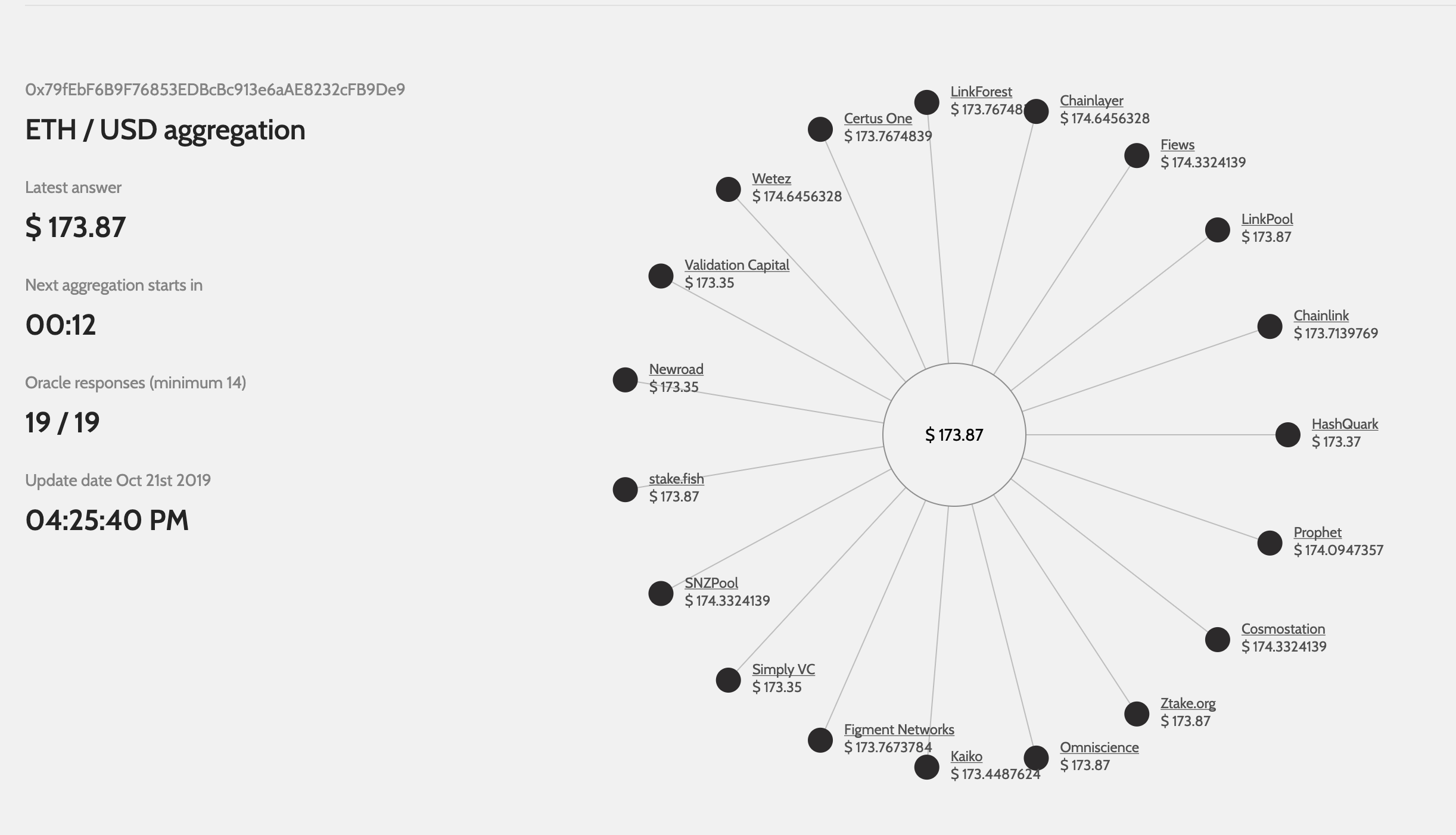

Prices are committed on-chain by a trusted oracle provided by Chainlink.

Please note that this repository is under development.

For the latest system documentation see docs.synthetix.io

For a guide from the community, see synthetix.community

A note on the branches used in this repo.

masterrepresents the contracts live onmainnetand all testnets.

When a new version of the contracts makes its way through all testnets, it eventually becomes promoted in master, with semver reflecting contract changes in the major or minor portion of the version (depending on backwards compatibility). patch changes are simply for changes to the JavaScript interface.

Please see docs.synthetix.io/contracts/testing for an overview of the automated testing methodologies.

This repo may be installed via npm install to support both node.js scripting applications and Solidity contract development.

💯 Please see our walkthroughs for code examples in both JavaScript and Solidity: docs.synthetix.io/integrations

All interfaces are available via the path synthetix/contracts/interfaces.

⚡ In your code, the key is to use IAddressResolver which can be tied to the immutable proxy: ReadProxyAddressResolver (introduced in SIP-57). You can then fetch Synthetix, FeePool, Depot, et al via IAddressResolver.getAddress(bytes32 name) where name is the bytes32 version of the contract name (case-sensitive). Or you can fetch any synth using IAddressResolver.getSynth(bytes32 synth) where synth is the bytes32 name of the synth (e.g. iETH, sUSD, sDEFI).

E.g.

npm install synthetix

then you can write Solidity as below (using a compiler that links named imports via node_modules):

pragma solidity 0.5.16;

import 'synthetix/contracts/interfaces/IAddressResolver.sol';

import 'synthetix/contracts/interfaces/ISynthetix.sol';

contract MyContract {

// This should be instantiated with our ReadProxyAddressResolver

// it's a ReadProxy that won't change, so safe to code it here without a setter

// see https://docs.synthetix.io/addresses for addresses in mainnet and testnets

IAddressResolver public synthetixResolver;

constructor(IAddressResolver _snxResolver) public {

synthetixResolver = _snxResolver;

}

function synthetixIssue() external {

ISynthetix synthetix = synthetixResolver.getAddress('Synthetix');

require(synthetix != address(0), 'Synthetix is missing from Synthetix resolver');

// Issue for msg.sender = address(MyContract)

synthetix.issueMaxSynths();

}

function synthetixIssueOnBehalf(address user) external {

ISynthetix synthetix = synthetixResolver.getAddress('Synthetix');

require(synthetix != address(0), 'Synthetix is missing from Synthetix resolver');

// Note: this will fail if `DelegateApprovals.approveIssueOnBehalf(address(MyContract))` has

// not yet been invoked by the `user`

synthetix.issueMaxSynthsOnBehalf(user);

}

}getAST({ source, match = /^contracts\// })Returns the Abstract Syntax Tree (AST) for all compiled sources. Optionally addsourceto restrict to a single contract source, and setmatchto an empty regex if you'd like all source ASTs including third-party contractsgetPathToNetwork({ network, file = '' })Returns the path to the folder (or file within the folder) for the given networkgetSource({ network })Returnabiandbytecodefor a contractsourcegetSuspensionReasons({ code })Return mapping ofSystemStatussuspension codes to string reasonsgetStakingRewards({ network })Return the list of staking reward contracts available.getSynths({ network })Return the list of synths for a networkgetTarget({ network })Return the information about a contract'saddressandsourcefile. The contract names are those specified in docs.synthetix.io/addressesgetTokens({ network })Return the list of tokens (synths andSNX) used in the system, along with their addresses.getUsers({ network })Return the list of user accounts within the Synthetix protocol (e.g.owner,fee, etc)getVersions({ network, byContract = false })Return the list of deployed versions to the network keyed by tagged version. IfbyContractistrue, it keys bycontractname.networksReturn the list of supported networkstoBytes32Convert any string to abytes32value

const snx = require('synthetix');

snx.getAST();

/*

{ 'contracts/AddressResolver.sol':

{ imports:

[ 'contracts/Owned.sol',

'contracts/interfaces/IAddressResolver.sol',

'contracts/interfaces/ISynthetix.sol' ],

contracts: { AddressResolver: [Object] },

interfaces: {},

libraries: {} },

'contracts/Owned.sol':

{ imports: [],

contracts: { Owned: [Object] },

interfaces: {},

libraries: {} },

*/

snx.getAST({ source: 'Synthetix.sol' });

/*

{ imports:

[ 'contracts/ExternStateToken.sol',

'contracts/MixinResolver.sol',

'contracts/interfaces/ISynthetix.sol',

'contracts/TokenState.sol',

'contracts/interfaces/ISynth.sol',

'contracts/interfaces/IERC20.sol',

'contracts/interfaces/ISystemStatus.sol',

'contracts/interfaces/IExchanger.sol',

'contracts/interfaces/IIssuer.sol',

'contracts/interfaces/ISynthetixState.sol',

'contracts/interfaces/IExchangeRates.sol',

'contracts/SupplySchedule.sol',

'contracts/interfaces/IRewardEscrow.sol',

'contracts/interfaces/IHasBalance.sol',

'contracts/interfaces/IRewardsDistribution.sol' ],

contracts:

{ Synthetix:

{ functions: [Array],

events: [Array],

variables: [Array],

modifiers: [Array],

structs: [],

inherits: [Array] } },

interfaces: {},

libraries: {} }

*/

// Get the path to the network

snx.getPathToNetwork({ network: 'mainnet' });

//'.../Synthetixio/synthetix/publish/deployed/mainnet'

// retrieve an object detailing the contract ABI and bytecode

snx.getSource({ network: 'sepolia', contract: 'Proxy' });

/*

{

bytecode: '0..0',

abi: [ ... ]

}

*/

snx.getSuspensionReasons();

/*

{

1: 'System Upgrade',

2: 'Market Closure',

3: 'Circuit breaker',

99: 'Emergency',

};

*/

// retrieve the array of synths used

snx.getSynths({ network: 'sepolia' }).map(({ name }) => name);

// ['sUSD', 'sEUR', ...]

// retrieve an object detailing the contract deployed to the given network.

snx.getTarget({ network: 'sepolia', contract: 'ProxySynthetix' });

/*

{

name: 'ProxySynthetix',

address: '0x322A3346bf24363f451164d96A5b5cd5A7F4c337',

source: 'Proxy',

link: 'https://sepolia.etherscan.io/address/0x322A3346bf24363f451164d96A5b5cd5A7F4c337',

timestamp: '2019-03-06T23:05:43.914Z',

txn: '',

network: 'sepolia'

}

*/

// retrieve the list of system user addresses

snx.getUsers({ network: 'mainnet' });

/*

[ { name: 'owner',

address: '0xEb3107117FEAd7de89Cd14D463D340A2E6917769' },

{ name: 'deployer',

address: '0xEde8a407913A874Dd7e3d5B731AFcA135D30375E' },

{ name: 'marketClosure',

address: '0xC105Ea57Eb434Fbe44690d7Dec2702e4a2FBFCf7' },

{ name: 'oracle',

address: '0xaC1ED4Fabbd5204E02950D68b6FC8c446AC95362' },

{ name: 'fee',

address: '0xfeEFEEfeefEeFeefEEFEEfEeFeefEEFeeFEEFEeF' },

{ name: 'zero',

address: '0x0000000000000000000000000000000000000000' } ]

*/

snx.getVersions();

/*

{ 'v2.21.12-107':

{ tag: 'v2.21.12-107',

fulltag: 'v2.21.12-107',

release: 'Hadar',

network: 'sepolia',

date: '2020-05-08T12:52:06-04:00',

commit: '19997724bc7eaceb902c523a6742e0bd74fc75cb',

contracts: { ReadProxyAddressResolver: [Object] }

}

}

*/

snx.networks;

// [ 'local', 'sepolia', 'mainnet' ]

snx.toBytes32('sUSD');

// '0x7355534400000000000000000000000000000000000000000000000000000000'Same as above but as a CLI tool that outputs JSON, using names without the get prefixes:

$ npx synthetix ast contracts/Synth.sol

{

"imports": [

"contracts/Owned.sol",

"contracts/ExternStateToken.sol",

"contracts/MixinResolver.sol",

"contracts/interfaces/ISynth.sol",

"contracts/interfaces/IERC20.sol",

"contracts/interfaces/ISystemStatus.sol",

"contracts/interfaces/IFeePool.sol",

"contracts/interfaces/ISynthetix.sol",

"contracts/interfaces/IExchanger.sol",

"contracts/interfaces/IIssue"

# ...

]

}

$ npx synthetix bytes32 sUSD

0x7355534400000000000000000000000000000000000000000000000000000000

$ npx synthetix networks

[ 'local', 'sepolia', 'mainnet' ]

$ npx synthetix source --network sepolia --contract Proxy

{

"bytecode": "0..0",

"abi": [ ... ]

}

$ npx synthetix suspension-reason --code 2

Market Closure

$ npx synthetix synths --network sepolia --key name

["sUSD", "sEUR", ... ]

$ npx synthetix target --network sepolia --contract ProxySynthetix

{

"name": "ProxySynthetix",

"address": "0x322A3346bf24363f451164d96A5b5cd5A7F4c337",

"source": "Proxy",

"link": "https://sepolia.etherscan.io/address/0x322A3346bf24363f451164d96A5b5cd5A7F4c337",

"timestamp": "2019-03-06T23:05:43.914Z",

"network": "sepolia"

}

$ npx synthetix users --network mainnet --user oracle

{

"name": "oracle",

"address": "0xaC1ED4Fabbd5204E02950D68b6FC8c446AC95362"

}

$ npx synthetix versions

{

"v2.0-19": {

"tag": "v2.0-19",

"fulltag": "v2.0-19",

"release": "",

"network": "mainnet",

"date": "2019-03-11T18:17:52-04:00",

"commit": "eeb271f4fdd2e615f9dba90503f42b2cb9f9716e",

"contracts": {

"Depot": {

"address": "0x172E09691DfBbC035E37c73B62095caa16Ee2388",

"status": "replaced",

"replaced_in": "v2.18.1"

},

"ExchangeRates": {

"address": "0x73b172756BD5DDf0110Ba8D7b88816Eb639Eb21c",

"status": "replaced",

"replaced_in": "v2.1.11"

},

# ...

}

}

}

$ npx synthetix versions --by-contract

{

"Depot": [

{

"address": "0x172E09691DfBbC035E37c73B62095caa16Ee2388",

"status": "replaced",

"replaced_in": "v2.18.1"

},

{

"address": "0xE1f64079aDa6Ef07b03982Ca34f1dD7152AA3b86",

"status": "current"

}

],

"ExchangeRates": [

{

"address": "0x73b172756BD5DDf0110Ba8D7b88816Eb639Eb21c",

"status": "replaced",

"replaced_in": "v2.1.11"

},

# ...

],

# ...

}